Think taxes are higher than ever? Think again.

-

No new posts

No new posts

| Moderators: k9car363, the bear, DerekL, alicefoeller | Reply |

|

2010-05-11 1:58 PM 2010-05-11 1:58 PM |

Pro  3932 3932         Irvine, California Irvine, California |  Subject: Think taxes are higher than ever? Think again. Subject: Think taxes are higher than ever? Think again.Taxes are at their lowest levels since 1950: http://www.usatoday.com/money/perfi/taxes/2010-05-10-taxes_N.htm |

|

2010-05-11 2:06 PM 2010-05-11 2:06 PM in reply to: #2851764 in reply to: #2851764 |

Pro  4909 4909        Hailey, ID Hailey, ID |  Subject: RE: Think taxes are higher than ever? Think again. Subject: RE: Think taxes are higher than ever? Think again.Statistics don't lie, but liars use statistics (not you tripolar, the article writer). It is so much more complicated than saying we had 23% less taxes than income. Right now with so many people not paying taxes, the tax burden is higher on those making more. Also one of their main points was that we are spending so little because of the recession, their was a major drop in sales taxes. That doesn't point to any tax cuts, but to a bad economy. |

2010-05-11 2:08 PM 2010-05-11 2:08 PM in reply to: #2851764 in reply to: #2851764 |

Master 1895 1895        |  Subject: RE: Think taxes are higher than ever? Think again. Subject: RE: Think taxes are higher than ever? Think again.People are also making less than they were in the past, which means they are paying less in income taxes and buying less which means less in sales taxes (I'll post a link to supporting info later, I'm blocked out at work). And it isn't necessarily always about the amount we pay in taxes, but about how this money is being used and how people in the government are always crying poor...threatening that they will cut programs if they don't raise taxes. (Again, will post supporting information as soon as I can). |

2010-05-11 2:08 PM 2010-05-11 2:08 PM in reply to: #2851764 in reply to: #2851764 |

Pro  4909 4909        Hailey, ID Hailey, ID |  Subject: RE: Think taxes are higher than ever? Think again. Subject: RE: Think taxes are higher than ever? Think again.• Sales tax. Consumers cut spending sharply in this downturn, thereby paying less in sales taxes. Also this includes Federal, State and local taxes. Most people are talking about federal income taxes specifically. Major factors for this downturn are high unemployment, low spending, low home ownership and the 'pay to work' tax "credit" (read: government welfare in the tax system). |

2010-05-11 2:29 PM 2010-05-11 2:29 PM in reply to: #2851802 in reply to: #2851802 |

Champion  6056 6056     Menomonee Falls, WI Menomonee Falls, WI |  Subject: RE: Think taxes are higher than ever? Think again. Subject: RE: Think taxes are higher than ever? Think again.Let's also not forget the many increases in taxes which have been rebranded as "fees" or built-in to the cost of goods. Many of these were non-existent in 1950, yet are significant in terms of real money out-of-pocket today. |

2010-05-11 2:41 PM 2010-05-11 2:41 PM in reply to: #2851764 in reply to: #2851764 |

Champion  5376 5376        PA PA |  Subject: RE: Think taxes are higher than ever? Think again. Subject: RE: Think taxes are higher than ever? Think again.Amazing! It must be true if USA Today found someone to write it up as a story. |

|

2010-05-11 3:07 PM 2010-05-11 3:07 PM in reply to: #2851966 in reply to: #2851966 |

Subject: ... Subject: ...This user's post has been ignored. |

2010-05-11 3:07 PM 2010-05-11 3:07 PM in reply to: #2851966 in reply to: #2851966 |

Subject: ... Subject: ...This user's post has been ignored. Edited by AcesFull 2010-05-11 3:08 PM |

2010-05-11 3:10 PM 2010-05-11 3:10 PM in reply to: #2851902 in reply to: #2851902 |

Member 1699 1699      |  Subject: RE: Think taxes are higher than ever? Think again. Subject: RE: Think taxes are higher than ever? Think again.scoobysdad - 2010-05-11 2:29 PM Let's also not forget the many increases in taxes which have been rebranded as "fees" or built-in to the cost of goods. Many of these were non-existent in 1950, yet are significant in terms of real money out-of-pocket today. +1 Take a look at a phone bill, a utility bill, a receipt for air travel, the real cost of gasoline, and many, many other everyday expenses and look how much money goes to the local, state and federal governments. That doesn't include big ticket items such as real estate and death taxes. Income and sales tax are far from inclusive of all government levies. I am also curious as to the numbers behind those statistics. It is very easy to skew data. |

2010-05-11 3:11 PM 2010-05-11 3:11 PM in reply to: #2852076 in reply to: #2852076 |

Pro 4277 4277        Parker, CO Parker, CO |  Subject: RE: Think taxes are higher than ever? Think again. Subject: RE: Think taxes are higher than ever? Think again.AcesFull - 2010-05-11 2:07 PM Pector55 - 2010-05-11 2:41 PM Amazing! It must be true if USA Today found someone to write it up as a story. When I bash FOXNews, as I often do, I generally try to cite a more neutral (that is non-liberal media) set of facts. I learned something today! |

2010-05-11 3:15 PM 2010-05-11 3:15 PM in reply to: #2852076 in reply to: #2852076 |

Champion 6056 6056     Menomonee Falls, WI Menomonee Falls, WI |  Subject: RE: Think taxes are higher than ever? Think again. Subject: RE: Think taxes are higher than ever? Think again.AcesFull - 2010-05-11 3:07 PM Pector55 - 2010-05-11 2:41 PM Amazing! It must be true if USA Today found someone to write it up as a story. While they do cite a liberal group when doing their analysis, it would be better if there was some counter to the claim, other than "but, but, USA Today!" When I bash FOXNews, as I often do, I generally try to cite a more neutral (that is non-liberal media) set of facts. The reality is, our taxes are not high enough. Having lived in VA and MN, I can comfortably say that the higher taxes I pay here in MN seem to have an impact in such things as quality of schools, community centers, transportation, parks, policing and govt services. I may have less in my paycheck, but my quality of life is better. My children are getting a better education and preparation to take on adulthood in a few years. |

|

2010-05-11 3:19 PM 2010-05-11 3:19 PM in reply to: #2852112 in reply to: #2852112 |

Subject: ... Subject: ...This user's post has been ignored. |

2010-05-11 3:21 PM 2010-05-11 3:21 PM in reply to: #2852112 in reply to: #2852112 |

Master 2802 2802      Minnetonka, Minnesota Minnetonka, Minnesota |  Subject: RE: Think taxes are higher than ever? Think again. Subject: RE: Think taxes are higher than ever? Think again.MN here too. Too bad the "quality of life" seems to be slipping as the state tax burden has "fallen" to middle of the pack under republican and independent governors. |

2010-05-11 3:26 PM 2010-05-11 3:26 PM in reply to: #2852132 in reply to: #2852132 |

Subject: ... Subject: ...This user's post has been ignored. |

2010-05-11 3:53 PM 2010-05-11 3:53 PM in reply to: #2852091 in reply to: #2852091 |

Pro 3932 3932         Irvine, California Irvine, California |  Subject: RE: Think taxes are higher than ever? Think again. Subject: RE: Think taxes are higher than ever? Think again.eberulf - 2010-05-11 1:10 PM scoobysdad - 2010-05-11 2:29 PM Let's also not forget the many increases in taxes which have been rebranded as "fees" or built-in to the cost of goods. Many of these were non-existent in 1950, yet are significant in terms of real money out-of-pocket today. +1 Take a look at a phone bill, a utility bill, a receipt for air travel, the real cost of gasoline, and many, many other everyday expenses and look how much money goes to the local, state and federal governments. That doesn't include big ticket items such as real estate and death taxes. Income and sales tax are far from inclusive of all government levies. I am also curious as to the numbers behind those statistics. It is very easy to skew data. According to the article: Federal, state and local taxes — including income, property, sales and other taxes — consumed 9.2% of all personal income in 2009, the lowest rate since 1950, the Bureau of Economic Analysis reports. The Bureau of Economic Analysis is a part of the US Dept. of Commerce. I visited their website briefly but haven't yet found the actual article or table that mentions this info. But having said that, the conclusions don't surprise me -- we definitely pay lower taxes here in the US than most other developed nations. |

2010-05-11 3:56 PM 2010-05-11 3:56 PM in reply to: #2852248 in reply to: #2852248 |

Champion 6056 6056     Menomonee Falls, WI Menomonee Falls, WI |  Subject: RE: Think taxes are higher than ever? Think again. Subject: RE: Think taxes are higher than ever? Think again.Tripolar - 2010-05-11 3:53 PM eberulf - 2010-05-11 1:10 PM scoobysdad - 2010-05-11 2:29 PM Let's also not forget the many increases in taxes which have been rebranded as "fees" or built-in to the cost of goods. Many of these were non-existent in 1950, yet are significant in terms of real money out-of-pocket today. +1 Take a look at a phone bill, a utility bill, a receipt for air travel, the real cost of gasoline, and many, many other everyday expenses and look how much money goes to the local, state and federal governments. That doesn't include big ticket items such as real estate and death taxes. Income and sales tax are far from inclusive of all government levies. I am also curious as to the numbers behind those statistics. It is very easy to skew data. According to the article: Federal, state and local taxes — including income, property, sales and other taxes — consumed 9.2% of all personal income in 2009, the lowest rate since 1950, the Bureau of Economic Analysis reports. The Bureau of Economic Analysis is a part of the US Dept. of Commerce. I visited their website briefly but haven't yet found the actual article or table that mentions this info. But having said that, the conclusions don't surprise me -- we definitely pay lower taxes here in the US than most other developed nations. Yeah, and the EU has proven to be such a sterling model to follow with regard to finance. |

|

2010-05-11 3:58 PM 2010-05-11 3:58 PM in reply to: #2852095 in reply to: #2852095 |

Subject: ... Subject: ...This user's post has been ignored. Edited by AcesFull 2010-05-11 4:00 PM |

2010-05-11 3:59 PM 2010-05-11 3:59 PM in reply to: #2852261 in reply to: #2852261 |

Subject: ... Subject: ...This user's post has been ignored. |

2010-05-12 1:13 AM 2010-05-12 1:13 AM in reply to: #2851764 in reply to: #2851764 |

Pro 3932 3932         Irvine, California Irvine, California |  Subject: RE: Think taxes are higher than ever? Think again. Subject: RE: Think taxes are higher than ever? Think again.I was bored this evening, so I searched a bit more on the BEA website. Here's a table that shows "personal current taxes" from 1950 to 2009 -- which is probably what the USA Today article relied on. To calculate the % tax rate, you can just divide Line 25 by Line 1 for the year you're interested in: http://www.bea.gov/national/nipaweb/TableView.asp?SelectedTable=58&Freq=Year&FirstYear=1950&LastYear=2009 Also, to be clear, this table excludes Social Security/Medicare taxes. (That's why the rate is 9.2% instead of 30% :P) |

2010-05-12 7:16 AM 2010-05-12 7:16 AM in reply to: #2851764 in reply to: #2851764 |

Expert 691 691      Cape Elizabeth, Maine Cape Elizabeth, Maine |  Subject: RE: Think taxes are higher than ever? Think again. Subject: RE: Think taxes are higher than ever? Think again.People are pissed about spending...there is no free lunch. On taxes, you do understand that half don't pay federal taxes, so yes the average tax payment rate may be down; this article doesn't address this, it lumps everyone together - a little misleading. |

2010-05-12 7:33 AM 2010-05-12 7:33 AM in reply to: #2852076 in reply to: #2852076 |

Champion 5376 5376        PA PA |  Subject: RE: Think taxes are higher than ever? Think again. Subject: RE: Think taxes are higher than ever? Think again.AcesFull - 2010-05-11 4:07 PM Pector55 - 2010-05-11 2:41 PM Amazing! It must be true if USA Today found someone to write it up as a story. While they do cite a liberal group when doing their analysis, it would be better if there was some counter to the claim, other than "but, but, USA Today!" When I bash FOXNews, as I often do, I generally try to cite a more neutral (that is non-liberal media) set of facts. The reality is, our taxes are not high enough. Having lived in VA and MN, I can comfortably say that the higher taxes I pay here in MN seem to have an impact in such things as quality of schools, community centers, transportation, parks, policing and govt services. I may have less in my paycheck, but my quality of life is better. My children are getting a better education and preparation to take on adulthood in a few years. It's irrelevant and this is not about left or right. If federal and state governments are so tax revenue strapped, they should be even MORE careful about how they spend it. I don't need to cite anything for people who pay attention to know that is not the case. The USA Today article IMO is just spin to prep the sheeple in preparing to accept new tax discussion. It's to lessen the blow for when tax increases are announced. Also, FWIW, inflation is the hidden tax that has not been discussed. Over the past few decades, inflation has admittedly been a tool of the fed reserve chairmen. The devaluation of our currency is also controlled by government actions. Why are neither of those discussed? Do you understand that you can purchase less as two change (inflation up and currency value down?) These are both manipulated by the federal government's actions. Once you devalue a person's personal income while asking for the same tax rate, you can't simply make the claim that you take less taxes. It's far from being that simple. Edited by Pector55 2010-05-12 7:36 AM |

|

2010-05-12 8:11 AM 2010-05-12 8:11 AM in reply to: #2851764 in reply to: #2851764 |

Master 2946 2946        Centennial, CO Centennial, CO |  Subject: RE: Think taxes are higher than ever? Think again. Subject: RE: Think taxes are higher than ever? Think again.A couple of other points. 1. Costs vs Income - A person in the 1950s could buy a house for what amounted to maybe 2/3 to 1 years worth of salary. Today even a modest house would be 2-5 years salary for most people. 2. 1950 there were far fewer entitlement programs and fewer people taking advantage of those that did exist. Therefore, the taxes needed by the Gov to sustain the programs was less. This allowed the taxes to be spent on other things like (Roads, Safety, other appropriate government costs). Those are just my quick thoughts on this. Government needs to look at what they have an obligation to pay for (education, safety, infrastructure). Pay those first, then whatever remains can be used for entitlement/welfare programs. If that means many entitlement/welfare programs don't get funding, so be it. Tax payers pay for a government to be responsive to their obligations. There has always been a diference between a need and a want. |

2010-05-12 8:24 AM 2010-05-12 8:24 AM in reply to: #2853306 in reply to: #2853306 |

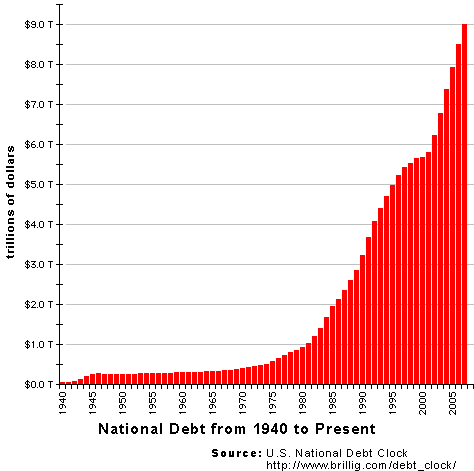

Champion 5615 5615   |  Subject: RE: Think taxes are higher than ever? Think again. Subject: RE: Think taxes are higher than ever? Think again.This may be the underlying data point that is used to support the "Lowest Taxes since 1950" argument but even I agree that the distinction is tenuous. Federal tax receipts are at their lowest since 1950 as a percentage of GDP. That does not necessarily translate into the conclusion that the tax burden upon individual income is at its lowest since 1950. From Tax Policy Center:  Edited by CubeFarmGopher 2010-05-12 8:39 AM |

2010-05-12 8:44 AM 2010-05-12 8:44 AM in reply to: #2851764 in reply to: #2851764 |

Master 1963 1963        |  Subject: RE: Think taxes are higher than ever? Think again. Subject: RE: Think taxes are higher than ever? Think again.This data probably makes sense considering that 47% of people don't pay federal income tax, that would fairly easily skew this data. Granted the 47% of people make less but that's a huge volume of people making money and paying nothing. Of course, they get to enjoy all the services that everyone else is paying for. You're welcome to tell me that this 47% pays other taxes, fees, etc but given the role of the Federal Government in an ever-increasing number of things that isn't going to cut it. I won't say this article is erroneous but I think it is very misleading. The truth is there are less taxpayers (defined as people who ACTUALLY pay taxes, as far as I'm concerned if you don't pay taxes you aren't a taxpayer) paying more and more. This data is from 2007: http://www.taxfoundation.org/news/show/250.html

There are a couple important points. First of all look at how skewed the tax rates are. Even compare the top 50% vs bottom 50%. It's not surprising you can come up with a rate that looks like its lower than its ever been. Second is, this table is largely duplicated at the state and local level. I know a lot of people think the "rich" will pay for all this crap. Based on our 2010 federal deficit (1.267 trillion dollars). Maybe we could tax the top 1% to get that deficit. That would require taxing them at an effective tax rate of about 64% and that's federal only. By the time they finish paying state and local, the numbers would be staggering. The point is there is something about not taxing to death those that produce and drive our economy (creating jobs along the way). One can keep lowering the definition of rich but you find that tax rates don't get into the realm of reasonable until you get down to taxing people who make even 60K. I also love how they invoke the Tea Party and how it's ridiculous. IT'S THE SPENDING STUPID. Government spending IS out of control. We're enjoying a level of services that is unsustainable at the current tax rate. But worse, it's unsustainable at even at very high tax levels. There is a chasm between what is expected and what one is expected to pay. Worse yet, the chasm is actually quite large specifically with people who don't pay taxes, they now feel they are owed things. We need to shut down spending not increase taxes. For those who want to emulate Europe (very high taxes, VAT, social welfare), you should consider moving TO Europe and leave the US alone. We don't have to guess what high taxes means for the economy, we already know (see all of Europe, Greece, UK, etc, etc).  I have posted this chart before as well and I'll do it again. It shows the budget deficit for the 2010 budget. Before anyone mentions it, completely zeroing out the defense budget (which includes the two wars) WOULD NOT close the budget gap. What you can see if the Federal Gov. did what it was supposed to do and stayed out of entitlement programs the budget would be FINE. But rather, we just passed another HUGE entitlement program in the form of health care.  At the end of the day the formula for government is NO different than that of a household. You make money and you spend money. Sometimes you have to borrow, knowing that you'll have to pay it off with interest at some point. You also can't have everything you want and sometimes you can't even have what you need. We can keep borrowing and eventually we'll pay when we blow up our currency. We can try and increase taxes (and you know it will only be on those who "make money") and we'll pay when productivity/revenue/GPD falls and there are no jobs. OR we can do the right thing and tighten our belts. The disaster we're in right is BOTH parties faults. Sadly, many Americans don't see this as a disaster. If a friend called you and told you he's in 100K in credit card debt and he plans to run a personal deficit for even the next year, what would you say? Call me crazy but I don't think we should take any benefits that we can't COMFORTABLY guarantee our kids will be able to enjoy. This post focuses solely on budgetary issues and I left out a lot of over comments constitutionality, personal liberty, personal choice when it comes to certain programs and what Government (especially Federal) should and shouldn't be doing but that's for another discussion. |

2010-05-12 9:05 AM 2010-05-12 9:05 AM in reply to: #2851764 in reply to: #2851764 |

Pro 4277 4277        Parker, CO Parker, CO |  Subject: RE: Think taxes are higher than ever? Think again. Subject: RE: Think taxes are higher than ever? Think again.^^^^ interesting information...thanks for posting. interesting how so many people will use the argument the the US spends the lions share on defense when actaully considerable more money is spent on entiltlements. agreed spending needs to get under control. sadly, I just done see it going that way. |

|

login

login

View profile

View profile Add to friends

Add to friends Go to training log

Go to training log Go to race log

Go to race log Send a message

Send a message View album

View album

CONNECT WITH FACEBOOK

CONNECT WITH FACEBOOK